toropets-adm.ru

Prices

General Purpose Loan

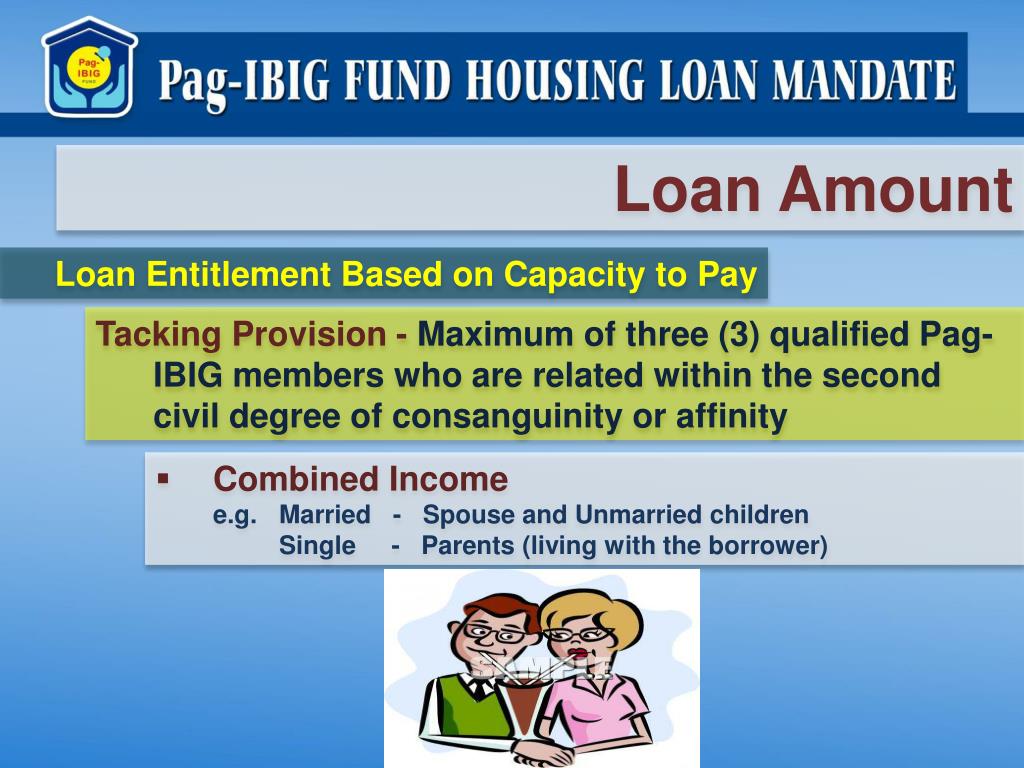

Whether you need a borrowing solution to help you with large purchases or to consolidate debt, we've got you covered. Special Purpose Credit Programs: Loans from private lenders or low- to middle- income borrowers generally in targeted communities. Find details about FHA loans. Call or apply in person for your personal loan. RBC Royal Bank offers fixed and variable rate loans, easy payment options and more. With a personal loan from PNC Bank, you can access the money you need right away. Check current interest rates and apply online today! Personal loans, which are typically unsecured, are repaid in monthly installments with interest. Because they are unsecured loans — meaning you don't have to. If you need a personal loan we offer both fixed and variable-rate loans with a wide range of terms to fit your budget. General Purpose Loan means a Loan permitted hereunder that is not a Tender Offer Loan. Sample 1. Based on. Apply now for the general purpose loan to fulfill your needs with advantageous credit interest rates and a repayment plan that best suits you. There are two types of loans: General purpose loan with a repayment period of 12 to 60 months. There is no documentation required and no need to state the. Whether you need a borrowing solution to help you with large purchases or to consolidate debt, we've got you covered. Special Purpose Credit Programs: Loans from private lenders or low- to middle- income borrowers generally in targeted communities. Find details about FHA loans. Call or apply in person for your personal loan. RBC Royal Bank offers fixed and variable rate loans, easy payment options and more. With a personal loan from PNC Bank, you can access the money you need right away. Check current interest rates and apply online today! Personal loans, which are typically unsecured, are repaid in monthly installments with interest. Because they are unsecured loans — meaning you don't have to. If you need a personal loan we offer both fixed and variable-rate loans with a wide range of terms to fit your budget. General Purpose Loan means a Loan permitted hereunder that is not a Tender Offer Loan. Sample 1. Based on. Apply now for the general purpose loan to fulfill your needs with advantageous credit interest rates and a repayment plan that best suits you. There are two types of loans: General purpose loan with a repayment period of 12 to 60 months. There is no documentation required and no need to state the.

Retirement plans may offer loans to participants, but a plan sponsor is not required to include loan provisions in its plan. Profit-sharing, money purchase. You can take either a home loan or a general purpose loan. General loans must be repaid within five years, while home loans can be repaid within 15 years. Personal loan rates as low as % APR With no application or early repayment fees, a USAA Bank personal loan is a good alternative to using a higher. Rocket Loans is an online finance company offering low rate personal loans from $ to $ Check out options in minutes without affecting your credit. Why apply for a Personal Loan? · Borrow up to $50, up front. Have money available for major purchases, unexpected bills, investments and more. · Payments. A personal unsecured personal loan can be used for just about anything, affording great flexibility. Let's look at some possible uses. We offer personal loan and line of credit options with fast and easy access to money for what matters to you. Taking a (k) loan means borrowing money from your retirement savings account. You can usually borrow up to $50,, which must be repaid. After researching how to apply for a personal loan, Sue learns she can take one out through a bank or online lender. General purpose-- for anything, max five year repayment. Residential-- only for a new residence, max 15 year repayment, must provide documentation. A BMO Personal Loan is good for virtually anything big you have planned, like buying a car, travelling, consolidating your debt, and more! If your borrowing needs vary, and you want to make on-going purchases, a personal line of credit is probably a better fit. As long as a plan provides for loans, the purpose of the loan or the participant's ability to borrow the same amount elsewhere is irrelevant in determining. Employees may use general-purpose loans for any purpose. These loans do not require documentation and have a repayment term of 1 to 5 years. You may only have five years to pay off a personal loan. No matter what type of loan you take, the minimum you can withdraw from your (k) is $1,, and. A (k) loan is a tool that allows you to borrow from the balance you've built up in your retirement account. Generally, if allowed by the plan, you may borrow. Merrill and Bank of America offers borrowing options, such as mortgages, lines of credit, custom lending, and auto loans for your personal and business. general purpose loan is five years from the date you receive the loan amount. The term for a loan to purchase a primary residence is 15 years. Loan. The minimum repayment period a participant may request for a general purpose loan is 12 months of scheduled payments. Related Definitions General Purpose Loan means a loan that is not a Home Loan. General Purpose Loan means a Loan designated by the Borrower as a General.

Silver Tax

Retail sales of coins and precious metal bullion are exempt from sales tax. This exemption applies to state, Regional Transportation District/Scientific and. (1) A sale of investment coins and bullion is exempt from the tax under this act. (2) As used in this section: (a) "Bullion" means gold, silver, or platinum. Sales valued at $1, or more of the following precious metals are exempt from the sales tax: rare coins of numismatic value; gold or silver bullion or coins;. Texas is one of many states that does not tax the sale of numismatic coins or gold, silver or platinum bullion. That means buyers do not have to pay the tax. For Silver coins, if the sales price for the specific coin is greater than or equal to % of the Silver value in the specific coin;; For Gold coins with 1. Do you have to pay capital gains tax on gold or silver? It depends on if you made any profit from the sale. When you buy a physical precious metal. Neither the sales tax nor the use tax applies to sales of "monetized bullion," nonmonetized gold or silver bullion, and numismatic coins provided the following. Figure out your premium tax credit. Provide some household details to get your second lowest cost Silver plan (SLCSP) premiums. Provided you hold it for more than 1 year, the capital gains tax on your net gain from selling a collectible is 28%. This level of tax is considerably higher. Retail sales of coins and precious metal bullion are exempt from sales tax. This exemption applies to state, Regional Transportation District/Scientific and. (1) A sale of investment coins and bullion is exempt from the tax under this act. (2) As used in this section: (a) "Bullion" means gold, silver, or platinum. Sales valued at $1, or more of the following precious metals are exempt from the sales tax: rare coins of numismatic value; gold or silver bullion or coins;. Texas is one of many states that does not tax the sale of numismatic coins or gold, silver or platinum bullion. That means buyers do not have to pay the tax. For Silver coins, if the sales price for the specific coin is greater than or equal to % of the Silver value in the specific coin;; For Gold coins with 1. Do you have to pay capital gains tax on gold or silver? It depends on if you made any profit from the sale. When you buy a physical precious metal. Neither the sales tax nor the use tax applies to sales of "monetized bullion," nonmonetized gold or silver bullion, and numismatic coins provided the following. Figure out your premium tax credit. Provide some household details to get your second lowest cost Silver plan (SLCSP) premiums. Provided you hold it for more than 1 year, the capital gains tax on your net gain from selling a collectible is 28%. This level of tax is considerably higher.

At Silver Tax Group, we understand how intimidating taxes can be, which is why our goal is always to provide personalized solutions that save you time and money. (1) A sale of investment coins and bullion is exempt from the tax under this act. (2) As used in this section: (a) "Bullion" means gold, silver, or platinum. Borough of Little Silver Tax Collector, Prospect Avenue Little Silver, NJ , Telephone, Email: [email protected] Washington state tax attorney Martin Silver has over 25 years experience representing taxpayers in disputes with state & federal authorities. Gross income from sales of precious metal bullion (gold bars, processed nuggets, etc.) and monetized bullion (coins, etc.) is generally exempt from tax. Silver Tax Group, Farmington Hills. likes · 1 was here. Resolve Your IRS Headaches & Tax Issues With Experienced Tax Attorneys and hire one of the. A plan's tax qualification under IRC Section (a) is not affected by an Gold, silver, platinum, palladium and coins. The following coins and. (1) Sales and use taxes shall not be imposed on the gross receipts from silver, platinum, or palladium, or a combination of these, for which the. (2) The sale, use, consumption, or storage for use in this state of bullion is subject to tax. For purposes of this rule, “bullion” means gold, silver, or. Bullion and investment coins, sales and use tax exemption. — In addition to the exemptions granted pursuant to the provisions of section Texas does not tax the sale of gold, silver, or platinum bullion, including numismatic coins, as of Foreign gold coins, silver coins, and other foreign currency are not considered legal tender for purposes of this exemption. They may be “legal tender” in the. You should buy only bullion coins, as these do not carry a sales tax. Rare coins, in some areas including Seattle, are taxed as much as % extra. NRS D “Sale of gold or silver” defined. NRS D “Securities” defined. NRS D “Taxable year” defined. The sale of any other coin and any other currency with a price of more than $, and the sale of gold, silver, and platinum bullion with a price of more. Bullion & Collectible State Sales Taxes. Gold, Silver, Platinum, Palladium, Copper & Supplies. Can I Buy Gold and Silver Tax-Free? When. Coins—Option to Purchase. A coin shop has an option from a bank to purchase silver dimes which the bank holds and makes available for purchase in. Ebay can not charge Tax on gold or silver if the items value is due to its gold content, or silver. It is a Federal crime total gold sales. Some states charge a. We have more than years of combined experience protecting the rights of individuals and businesses involved in tax controversies. Elsewhere in Europe though, Norway has exempted both gold and silver bullion coins with face value from VAT; Norway is part of the wider EEA (European Economic.

How To Get Personal Bank Loan

How Can I Get a Personal Loan? · Assessing Your Finances: Understanding your credit score and financial stability. · Research: Exploring various lenders and loan. Through the personal loan program at Axos Bank, you can borrow money fast Should I Get a Personal Loan or Refinance My Mortgage. When homeowners. Before applying for a loan, you should consider the 5 Cs of Credit. Learn what lenders look for when you want to get approved for a loan. You'll have the guidance of a local loan officer, from application to getting your funds. They'll be there to answer your questions, and help you get your funds. Ready to get started? Get a quick decision and a great rate on a personal loan! *Other loan products, minimum loan amounts, rates and terms available. Subject. Current customers can access funds in minutes with an online Personal Loan! Get access to the cash you need with an Academy Bank Express Loan. Wondering how to get a personal loan? Learn about the different types of loans, their requirements and how they can be utilized. ScotiaLine® Personal Line of Credit. Credit limits starting from $5, and up to $75,*; Access to funds through Mobile App, Online Banking, ABM. With a personal loan from PNC Bank, you can access the money you need right away. Check current interest rates and apply online today! How Can I Get a Personal Loan? · Assessing Your Finances: Understanding your credit score and financial stability. · Research: Exploring various lenders and loan. Through the personal loan program at Axos Bank, you can borrow money fast Should I Get a Personal Loan or Refinance My Mortgage. When homeowners. Before applying for a loan, you should consider the 5 Cs of Credit. Learn what lenders look for when you want to get approved for a loan. You'll have the guidance of a local loan officer, from application to getting your funds. They'll be there to answer your questions, and help you get your funds. Ready to get started? Get a quick decision and a great rate on a personal loan! *Other loan products, minimum loan amounts, rates and terms available. Subject. Current customers can access funds in minutes with an online Personal Loan! Get access to the cash you need with an Academy Bank Express Loan. Wondering how to get a personal loan? Learn about the different types of loans, their requirements and how they can be utilized. ScotiaLine® Personal Line of Credit. Credit limits starting from $5, and up to $75,*; Access to funds through Mobile App, Online Banking, ABM. With a personal loan from PNC Bank, you can access the money you need right away. Check current interest rates and apply online today!

Choose a personal loan for lump sum expenses like travel, renovations, or debt consolidation. Unlike a line of credit, you'll receive your funds all at once. You get access to the full amount faster because there's no collateral required. There are no origination fees, you receive a fixed rate for the life of your. With our help, you choose the loan that is right for your needs and your budget. And all decisions concerning your loan application are made locally. Our personal loan allows you to apply for a lump sum payment. You can use this loan for debt consolidation, home improvements, a trip, or nearly anything else. What are the requirements for a personal loan? · Have a valid U.S. SSN. · Be at least 18 years old. · Have a minimum individual or household annual income of at. Application Process for an Unsecured Personal Loan · Be 18 years of age or older · Live within the following states: AK, CO, CT, ID, IN, MA, ME, MI, NY, OH, OR. Answer: While it's good to start thinking about the documents you'll need to apply for a personal loan, we recommend calling our lending center at () A personal loan is a convenient way to borrow a lump-sum amount. With this unsecured loan, you can get approved for a certain amount based on your credit, income and other factors. Whether you need to borrow for a home improvement project, debt consolidation or education, you get more than just competitive rates and flexible options. There's no secret formula or magic trick for how to get approved for a personal loan. It largely hinges on your credit rating and financial standing. Discover how to apply for a personal loan. Use one of these three methods and benefit from a generous financing solution to fund your long and short-term. A personal loan is a great way to cover expenses like preparing for the arrival of a new baby, a home improvement project, paying for your wedding or. Personal Loan features & benefits · Apply online in minutes. · Flexible terms · No fees · Rate discount · We'll take care of your needs · Consolidate credit card debt. Fast approvals. Same-day access to cash. Truist offers personal loans and other lines of credit to help manage big expenses. Check today's rates & apply. Ready to get started? Check out our most popular lending products. CIBC Personal Loan. Personal Loan features & benefits · Apply online in minutes. · Flexible terms · No fees · Rate discount · We'll take care of your needs · Consolidate credit card debt. Collateral is usually not required and personal loans typically have lower interest rates than most credit cards. Since interest rates and loan terms on a. Personal loans that don't require collateral are called unsecured loans. But without collateral, the interest rate on the loan may be higher. Interest is a. Go online and fill out the application with required information. Get a decision within a few days. If approved, you can go to a branch to sign your loan.

Example Of Mid Cap Stock

Essentially it is determined by the current price per share multiplied by the total outstanding shares. Market capitalization is often quoted by asset and. Small, mid, and large cap stocks tend to have different performance characteristics. For example, small cap Stock index and Ibbotson SBBI US. Small Stock. Mid-cap companies typically have a market capitalization between $2 billion and $10 billion and may offer investors growth opportunities. A mid-cap stock is the next step up from a small-cap stock. These are companies with a market capitalisation of $2 billion–$10 billion. Some popular mid-cap. Investing in Mid-Cap Stocks · 1. Ambarella (AMBA %) · 2. Clover Health Investments (CLOV %) · 3. Stitch Fix (SFIX %). Mid caps can be a lower risk option than their small-cap peers, as they tend to have stronger balance sheets, readier access to capital markets, more. Examples of mid-cap stocks include 3D Systems Corp (a maker of 3D printers) and the home appliance company Whirlpool. Small-cap stocks. Small-cap companies have. Midcap growth stocks to look into are medical, with 10K boomers retiring per day, they'll soon need their cholesterol and blood pressure meds. MarketRank™ ; CACI International Inc stock logo. CACI. CACI International. of 5 stars / 5 stars, ; Huntington Ingalls Industries, Inc. stock logo. Essentially it is determined by the current price per share multiplied by the total outstanding shares. Market capitalization is often quoted by asset and. Small, mid, and large cap stocks tend to have different performance characteristics. For example, small cap Stock index and Ibbotson SBBI US. Small Stock. Mid-cap companies typically have a market capitalization between $2 billion and $10 billion and may offer investors growth opportunities. A mid-cap stock is the next step up from a small-cap stock. These are companies with a market capitalisation of $2 billion–$10 billion. Some popular mid-cap. Investing in Mid-Cap Stocks · 1. Ambarella (AMBA %) · 2. Clover Health Investments (CLOV %) · 3. Stitch Fix (SFIX %). Mid caps can be a lower risk option than their small-cap peers, as they tend to have stronger balance sheets, readier access to capital markets, more. Examples of mid-cap stocks include 3D Systems Corp (a maker of 3D printers) and the home appliance company Whirlpool. Small-cap stocks. Small-cap companies have. Midcap growth stocks to look into are medical, with 10K boomers retiring per day, they'll soon need their cholesterol and blood pressure meds. MarketRank™ ; CACI International Inc stock logo. CACI. CACI International. of 5 stars / 5 stars, ; Huntington Ingalls Industries, Inc. stock logo.

MDY · SPDR S&P Midcap ETF Trust, Equity ; VOE · Vanguard Mid-Cap Value ETF, Equity ; VOT · Vanguard Mid-Cap Growth ETF, Equity ; IWS · iShares Russell Mid-Cap. Market capitalization (market cap) is calculated by multiplying a company's current stock price by the number of its existing shares. For example, a stock with. Growth Midcap Stocks ; 3. Panorama Studios, ; 4. Sharda Motor, ; 5. Kothari Petroche, ; 6. Authum Invest, S&P MidCap component stocks. Mid-cap Stocks · 1. Tips Industries, , , , , , , , , · 2. Waaree Renewab. , , A mid-cap fund is a pooled investment vehicle (eg a mutual fund or ETF) that explicitly invests in the stocks of mid-cap companies. During the growth phase of the economy, mid-sized companies tend to grow at a faster rate than large cap or blue chip companies. On the other hand, during a. Mid Cap Stocks · Zee Entertainment Enterprises Ltd. · Sammaan Capital Ltd. · Reliance Infrastructure Ltd. · Reliance Power Ltd. · Rajesh Exports Ltd. · Blue Dart. Small Cap. Companies with a market capitalization between $ million and $2 billion are generally considered small cap. · Mid Cap. · Large Cap. · Dow Jones. Top schemes of Mid Cap Mutual Funds sorted by Returns ; Motilal Oswal Midcap Fund. #9 of 23 ; Quant Mid Cap Fund. #2 of 23 ; Edelweiss Mid Cap Fund. #10 of S&P MidCap component stocks. #2 IRFC; #3 POWER FINANCE CORPORATION; #4 REC; #5 TVS MOTORS. You can see the full list of the BSE Midcap stocks here. And for a fundamental analysis of. Fidelity® Mid-Cap Stock Fund FMCSX · Fidelity® Stock Selector Mid Cap Fund FSSMX · FMI Common Stock Fund Investor Class FMIMX · Madison Mid Cap Fund Class Y. Mid Cap 2Q Many oversold mid caps exhibit strong revenue growth For example, shares of software-as-a-service development company Freshworks. Global stocks returned % for the quarter, as measured by the FTSE Global All Cap Index. U.S. and emerging markets equities led the way. But the mid-cap market—which encompasses stocks in the range of about $7 billion to $35 billion in market cap—offers a world of opportunity for investors. XMMO · Invesco S&P MidCap Momentum ETF, Equity ; XHB · SPDR S&P Homebuilders ETF, Equity ; IMCG · iShares Morningstar Mid-Cap Growth ETF, Equity ; BBMC · JPMorgan. Faster Growth Potential Than Large Caps · Attractive Relative Valuation · Improved Portfolio Efficiency · Portfolio Construction · Stock Examples · HEICO Corporation. Mid cap: Between $2 and $10 billion in market capitalization. Small cap For example, small cap stocks have generated higher returns than large cap. Most Active Small-Cap Stocks · RDFN · How far do mortgage rates need to fall to spur a housing boom? · BIOBIO-BHELEHLNE · Palantir Technologies, Dell Technologies.

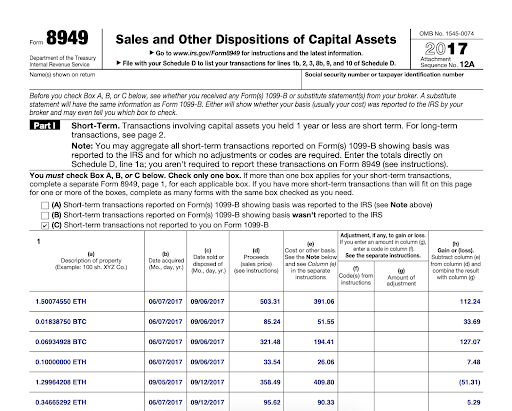

Crypto Form 8949

Generate tax Form on a crypto service and then prepare and e-file your taxes on FreeTaxUSA. Premium federal taxes are always free. Income from cryptocurrencies is reported using Forms , while Form covers capital gains, and Form B addresses other transactions. If you're. Form captures the details of every sale triggering a gain or loss. The details supporting the final calculation, include, but are not limited to, asset. This depends on your individual tax situation and your specific transactions involving bitcoin. If you sold bitcoin you may need to file IRS Form and a. All such transactions must be reported on Form and Schedule D. It's crucial to keep detailed records of every trade, including the date, amount, and value. Who needs to file crypto tax Form If you haven't earned any net capital gains from crypto transactions, you are not considered to have any taxable gains. You file Form with your Schedule D when you need to report additional information for the sale or exchange of capital assets like stocks, bonds, real. Koinly calculates your cryptocurrency taxes and helps you reduce them for next year. Simple & Reliable. Available in 20+ countries. Form & Schedule D. Generate your necessary crypto tax forms including IRS Form View an example of a full crypto tax report including all short and long term capital. Generate tax Form on a crypto service and then prepare and e-file your taxes on FreeTaxUSA. Premium federal taxes are always free. Income from cryptocurrencies is reported using Forms , while Form covers capital gains, and Form B addresses other transactions. If you're. Form captures the details of every sale triggering a gain or loss. The details supporting the final calculation, include, but are not limited to, asset. This depends on your individual tax situation and your specific transactions involving bitcoin. If you sold bitcoin you may need to file IRS Form and a. All such transactions must be reported on Form and Schedule D. It's crucial to keep detailed records of every trade, including the date, amount, and value. Who needs to file crypto tax Form If you haven't earned any net capital gains from crypto transactions, you are not considered to have any taxable gains. You file Form with your Schedule D when you need to report additional information for the sale or exchange of capital assets like stocks, bonds, real. Koinly calculates your cryptocurrency taxes and helps you reduce them for next year. Simple & Reliable. Available in 20+ countries. Form & Schedule D. Generate your necessary crypto tax forms including IRS Form View an example of a full crypto tax report including all short and long term capital.

Crypto taxes , Cryptocurrency tax IRS Form and Schedule D, Crypto gains, and losses. Cryptocurrency Tax consultant www. If a taxpayer checks Yes, then the IRS looks to see if Form (which tracks capital gains or losses) has been filed. If the taxpayer fails to report their. Koinly calculates your cryptocurrency taxes and helps you reduce them for next year. Simple & Reliable. Available in 20+ countries. Form & Schedule D. To report crypto losses, you should use Form and Form Schedule D. What if my crypto was stolen or lost? Losing cryptocurrency in one of the. Need to file crypto taxes with the IRS? Learn about the crypto tax forms you need & how to report crypto on taxes to the IRS by April If you sold stock through an online brokerage and had taxes withheld, you'll need to use Form Learn more from the tax experts at H&R Block. You fill out Form with your Schedule D when you have to report extra information from the sale of capital assets such as stocks, bonds, or cryptocurrencies. Key Takeaways · Reporting cryptocurrency on your tax return is mandatory in the U.S., utilizing Form for capital gains and losses, and integrating with. When preparing taxes, individuals dealing with cryptocurrency transactions may notice discrepancies between their transaction histories in wallets or exchanges. For as little as $, clients of Robinhood Crypto can use the services of Formcom to generate IRS Schedule D and Form Crypto Tax Calculator Capital Gains Report should be submitted with your Form if required. Long Term Gains. The name and SSN/TIN you fill in before. Is Form Required for Reporting Cryptocurrency Transactions? Form may be required when you realize a gain on cryptocurrency by buying and then. Just got my return back and my accountant listed crypto as a single line item on form , except he checked box C instead of Box A up top. Want to learn cryptocurrency taxation? In this guide, we cover IRS Form with instructions and how to do it. Form captures detail of every sale triggering a gain or loss, with all the details supporting the final calculation. Browser. Use your crypto transaction history from your wallet or exchange to enter your sales. OR; Use a crypto tax service to generate a Form of your crypto. Form is an IRS tax form used to report capital gains and losses from various transactions, such as the sale of stocks, bonds, real estate, and other. Form is a required addition to your annual tax return when you have sold capital assets such as stocks at a profit or a loss during the year. Coinpanda makes it easy to generate your Bitcoin and crypto tax reports Free tax forms Download IRS Form and Schedule D instantly. When preparing taxes, individuals dealing with cryptocurrency transactions may notice discrepancies between their transaction histories in wallets or exchanges.